Fintech means financial technology that aims to compete with conventional financial techniques in the delivery of monetary services. Fintech provides startups opportunities to access financial services digitally and on demand. Fintech startups can efficiently manage their financial needs, freeing up assets to spend money on different aspects of their businesses. Fintech companies are typically startups that use technology to provide banking, lending, payments, investment management, or other financial services.

The top fintech startups continue to develop unexpectedly, with new startups launching and installing financial institutions partnering with or acquiring fintech corporations to leverage their innovations. Fintech targets to make economic offerings more efficient, available, and customized to users. However, there are also dangers around data safety, privacy, and fairness that come with fintech solutions. Regulations are evolving to protect consumers while still enabling fintech innovation.

You Can Also Read: 10 Essential Financial Tools For Startups: Key To Successful Business

Table of Contents

Mobile banking apps

Mobile banking apps are a popular type of fintech startup that allows users to bank on the go using their smartphones. With a mobile banking app, you can take a look at your account balances and transaction records, view statements and payments, deposit checks by means of taking a photo, pay payments and send money to others, set up alerts and transfers, and more—all out of your smartphone.

The convenience and on-the-go access of mobile banking apps appeal to many consumers. It allows them to handle financial tasks whenever and wherever is most convenient for their schedules. However, it’s important to choose a reputable bank or credit union and ensure their mobile app uses strong security measures like multi-factor authentication, data encryption, and Touch ID or facial recognition login options.

Leading Top 5 Mobile Banking Apps

Bank of America

Bank of America Mobile Banking helps customers manage their finances on the go. The app allows users to check balances, pay bills, deposit checks, transfer funds, locate ATMs and branches, lock debit cards and get alerts. It provides access to BofA’s wide range of accounts and features like bill pay, Money Map, credit cards and rewards program. The app has a simple and intuitive interface with useful personal financial tools.

Citi Mobile app

The Citi Mobile app provides Citi customers easy and secure access to their bank accounts anytime, anywhere. The app offers features to check balances, pay bills, transfer funds, deposit checks, freeze cards, locate ATMs and branches and more. Customers get real-time alerts and notifications. They can also apply for Citi credit cards, loans and investments through the app. The mobile app provides a comprehensive yet easy-to-navigate banking experience.

The Chase Mobile app

The Chase Mobile app allows customers to manage all their Chase accounts from anywhere. The app provides a simple interface to check balances, pay bills, deposit checks, transfer funds, freeze cards, locate ATMs and branches and more. Customers get instant credit card and bank account alerts. They can also track spending by category and manage investments, mortgages and loans through the app. The Chase Mobile app offers a fast and convenient way to manage finances on the go.

The Ally Mobile Banking App

The Ally Mobile Banking App provides easy access to Ally Bank accounts from any mobile device. Through the app, customers can check balances, pay bills, transfer funds, freeze debit cards, deposit checks, locate ATMs and branches and more. They also get notifications and alerts to stay on top of their finances. The app’s features include bill pay, money transfer, check deposit and early direct deposit. Ally’s mobile app offers an intuitive and simple interface making banking easy and convenient.

The Discover Mobile App

The Discover Mobile App enables customers to manage their Discover credit cards and banking accounts from any mobile device. The app provides a simple interface to view balances, pay bills, transfer funds, lock credit cards, deposit checks, order replacement cards and locate ATMs. Customers receive notifications and alerts to stay on top of their accounts. Other features include person-to-person payments, bill pay and rewards tracking. The Discover mobile app offers a fast and secure way to bank on the go.

Loan companies

Loan companies that use algorithms and AI to quickly evaluate loan applications and provide approval and terms. Fintech for startups loan companies are also financial institutions that offer loans and other monetary services to clients with the help of technology. These companies often offer online loan applications, quick approval processes, and personalized loan options based on a customer’s creditworthiness and financial history.

Fintech loan companies may also provide decreased interest rates as compared to standard banks or credit score unions, as they have lower overhead costs and can leverage technology to streamline their operations.

Some of the top 4 fintech loan companies include

SoFi

SoFi is one of the largest fintech lending companies that offers personal loans, student loan refinancing, mortgages and more. They provide fast and easy online loan applications with competitive interest rates and terms. SoFi takes a more holistic approach to lending by considering factors like career trajectory, finances and creditworthiness. They offer excellent customer service and a variety of loan products to fit different needs.

LightStream

LightStream is an online lending platform from Truist Bank that offers personal loans and home equity loans for debt consolidation, home improvement, emergency expenses and more. They provide fast loan decisions and fund disbursement within just 1-2 days. LightStream offers competitive interest rates and terms with simple and transparent loan applications. Their loans do not require collateral, allow borrowers to select their loan terms and have no prepayment penalties.

Marcus

Marcus by Goldman Sachs offers personal loans, personal lines of credit and high-yield savings accounts. They provide straightforward online loan applications and funding within just a few days. Marcus prides itself on offering fair rates, fair terms and treating customers with respect. They have no fees, penalties and prepayment options to give customers flexibility. Their goal is to provide an exceptional and easy borrowing experience with fast funding and great customer service.

LendingPoint

LendingPoint is a fintech lender that provides personal loans, student refinancing loans, home improvement loans, business & merchant cash advance loans and auto loans. They simplify the loan application process and aim to fund borrowers within 24 hours. LendingPoint considers various factors like income, employment history and creditworthiness to make credit decisions. They offer competitive rates, low fees and flexible terms to suit different needs. Their loans are designed to help borrowers make purchases or manage cash flow.

Payment Apps and Services

Payment apps and services that let you easily transfer money to friends and family or pay for purchases. Fintech payment apps are mobile applications that enable users to make payments and transfer money electronically.

These apps use technology to facilitate transactions between individuals or agencies, getting rid of the want for physical foreign money and conventional price strategies like checks or credit scorecards.

Some of the Top 5 Payment Apps include:

Venmo

Venmo is a payment app owned by PayPal that allows users to easily send and receive money from friends and family. The app works by linking to a user’s bank account or debit card, making it simple to pay back roommates, split group purchases or pay someone back quickly. Venmo offers a social experience by showing users’ payments on a feed that can be shared publicly or kept private. The app has a simple and intuitive interface that many users find fun and easy to use.

Zelle

Zelle is a payment network owned by major U.S. banks that allows users to send and receive money directly between bank accounts. The app works by linking to a user’s online bank account, making it simple to pay or request money from friends, family or others in the Zelle network. Zelle transactions happen instantly and are free for personal payments. The app provides a fast, secure and social-free way to send funds to those you trust. It offers a simple, hassle-free user experience optimized for mobile devices.

PayPal

PayPal is an online payment system that allows users to send, receive and store money. The PayPal app makes it easy to pay online or in stores using a linked bank account, debit card or PayPal balance. The app allows users to pay friends and family, split bills, donate to charities and pay merchants. PayPal offers fraud protection and purchase protection on eligible transactions. The app provides a convenient and secure way for users to manage payments from their smartphones.

The Cash App

The Cash App from Square is a fast and simple way to send, spend, save and invest money. The app allows users to send money to friends, purchase stocks, access a debit card and request or withdraw cash at ATMs. The Cash App is useful for paying bills, splitting costs with friends, receiving money for selling items and receiving income. The app’s simple and clean interface makes managing money easy and intuitive. The Cash App also offers stock trading, bitcoin purchasing and a cash bonus program for users.

Robo-advisors

Robo-advisors are a type of fintech that provides automated investment management services. Using algorithms and AI, robo-advisors can create investment portfolios tailored to a user’s goals and risk tolerance. They adjust portfolios over time based on the markets and individual accounts.

The “robo” aspect refers to how these services function without human financial advisors being directly involved in decision-making or portfolio changes. As robo-advisors have grown, many traditional brokerages and investment corporations have launched their own robo-consultant services.

4 Leading Robo-Advisors Include

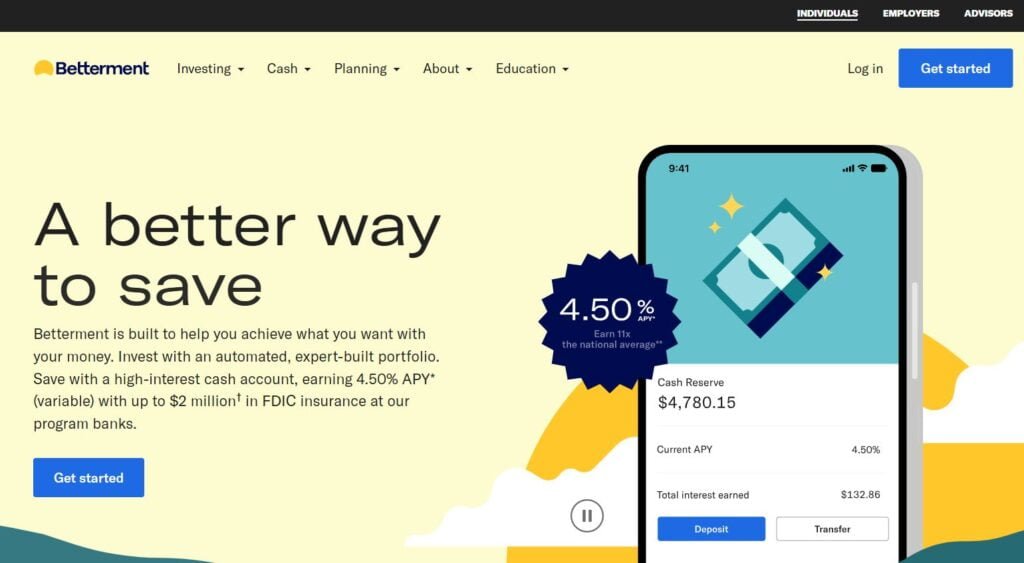

Betterment

Betterment is one of the largest and most well-known robo-advisors, managing over $25 billion in assets. Betterment uses an algorithm-based investment strategy to build and manage low-fee, globally diversified portfolios for clients. They offer tax-smart investing, automated rebalancing and tax-loss harvesting to maximize returns. Betterment manages everything for you and charges an affordable management fee based on your account size. The platform provides financial planning tools and an easy-to-use interface for a hassle-free investing experience.

Vanguard Digital Advisor

Vanguard Digital Advisor is an automated investment management tool from one of the world’s largest investment companies. It uses behavioural finance-based algorithms to build and manage an ETF portfolio for clients based on a risk profile. The platform provides automated rebalancing, ongoing portfolio monitoring and tax-loss harvesting. Vanguard Digital Advisor charges extremely low annual advisory fees. It offers a simplified, straightforward way to start and maintain a diversified portfolio with the benefits of Vanguard’s experienced investment advising team behind the scenes.

Wealthfront

Wealthfront is an automated investing service that uses algorithms and low-cost exchange-traded funds to manage customer portfolios. Wealthfront creates and manages globally diversified portfolios based on a client’s risk tolerance and time horizon. The platform offers automated tax-loss harvesting, tax optimization, automatic rebalancing, portfolio performance monitoring and personalized retirement planning. Wealthfront charges an affordable annual advisory fee and has a minimum balance requirement of $500. The intuitive platform provides an easy and accessible way to grow wealth over time with minimal effort.

Vanguard Personal Advisor Services

Vanguard Personal Advisor Services is an automated investing service from one of the largest and most reputable investment companies. The service builds and manages globally diversified, low-cost ETF portfolios based on a client’s risk tolerance and goals. Vanguard Personal Advisor Services provides ongoing portfolio management, rebalancing, tax-loss harvesting and personalized financial planning. The service charges an affordable annual advisory fee and requires a minimum account size of $50,000. Users get access to Vanguard’s investment expertise through an intuitive digital experience that simplifies the investment process.

Crowdfunding platforms

Crowdfunding platforms are a type of fintech that allows people and groups to elevate money from a large number of individuals online. Projects, products, or ventures are presented on the platform, and people can pledge money to support the things they want to see happen.

Reward-based crowdfunding offers rewards or pre-orders for backers, while equity crowdfunding provides backers with equity in a business. The future of crowdfunding may involve more niche platforms, international growth, and possibly new models beyond reward-based and equity-based structures.

4 Popular crowdfunding platforms include

Seed&Spark

SeedandSpark is a crowdfunding platform to raise money for independent film and media projects. Filmmakers can use Seed&Spark to find donors, sponsors and early subscribers for their projects. Seed&Spark offers a transparent and community-driven funding model that allows backers to give feedback and influence creative decisions. The platform matches projects with donors based on mutual interests and values. Seed&Spark acts as an advocate for projects, helping turn crowdfunding campaigns into sustainable businesses.

Indiegogo

Indiegogo is one of the largest global crowdfunding platforms, hosting campaigns for creative projects, businesses and causes. Indiegogo allows campaign owners to crowdfund their ideas through donations, rewards or equity funding. The platform offers features to help manage and promote crowdfunding projects through social sharing, email marketing and video hosting. Indiegogo aims to democratize access to funding and help creative ideas grow through community support. The platform has successfully funded over 1 million campaigns from entrepreneurs, inventors and change makers.

GoFundMe

GoFundMe is an online crowdfunding platform for personal causes that allows people to raise money for events ranging from life events and emergencies to personal causes and charitable organizations. Campaign organizers can create fundraisers to share with family, friends and online communities. GoFundMe makes it free and easy to generate donations through social networks and email. The platform allows donors to contribute via debit cards, credit cards or PayPal for a secure transaction. GoFundMe has successfully helped millions of people raise funds for important causes through the power of crowdfunding.

AngelList

AngelList is an online platform that assists startup companies in raising angel and seed investments. AngelList allows entrepreneurs to post profiles, financials and pitch decks to solicit investment from accredited angel investors and early-stage venture capital funds. The platform enables angels to search for promising startups to fund and provides deal due diligence tools for efficient decision-making. AngelList aims to revolutionize entrepreneurship and startup investing by connecting ambitious founders with the capital and guidance they need to succeed.

In conclusion, the best fintech startups have revolutionized the financial industry by leveraging technology to deliver innovative solutions and enhance financial services. These startups have disrupted traditional banking models by offering convenient, accessible, and user-friendly platforms for payments, lending, investing, and more. By leveraging advancements in artificial intelligence, blockchain, and mobile technologies, fintech for startups has empowered individuals and businesses to manage their finances more efficiently and securely. As the fintech startup opportunities continue to evolve, these startups will play a pivotal role in shaping the future of finance and transforming the way we transact and manage our financial lives.

FAQs

What is FinTech in startup?

FinTech in startup refers to the app of technology to provide innovative financial solutions, disrupting traditional banking methods and improving accessibility and efficiency in financial services.

How do I start a fintech startup?

To start a fintech startup, identify a specific problem in the financial industry, research the market, develop a unique solution, assemble a skilled team, secure funding, build partnerships, and launch and iterate your product.

What is the best opportunity for fintech?

The fintech startup opportunities lie in leveraging emerging technologies like artificial intelligence, blockchain, and machine learning to enhance financial inclusion and create personalized customer experiences.