Brief Overview

Founded – 2012

Founders – Dave Girouard, Anna Counselman, Paul Gu

Location – San Mateo, California, U.S.

Former name – Upstart

Operating Status – Active

Operating In – Fintech

Legal Name – Upstart Holdings, Inc.

Total Revenue – $842 million (2022) (Wikipedia)

Table of Contents

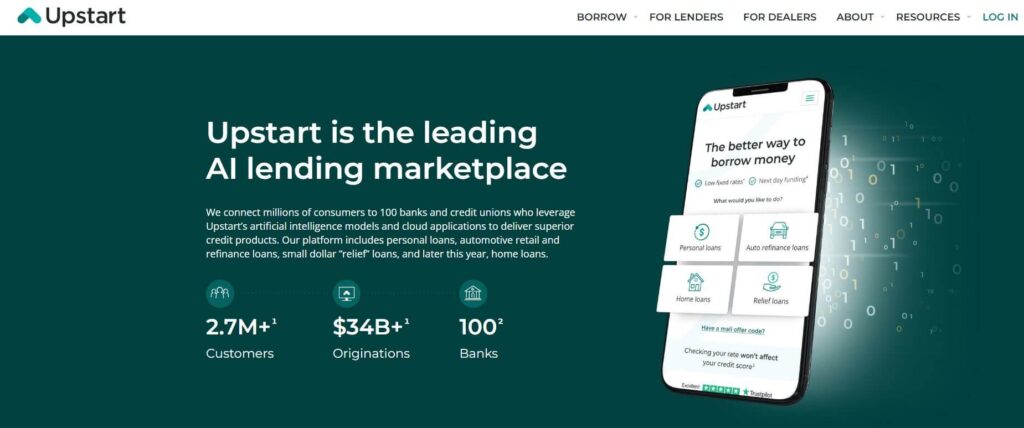

Upstart Company About

Upstart is an AI-driven lending company that collaborates with banks and credit unions to provide consumer loans. Its founders include Dave Girouard, President of Enterprise Google, Paul Gu, a Thiel Fellow, and Anna Counselman, former Manager of Global Enterprise Customer Programs and Gmail Consumer Operations at Google.

Upstart loan company founded in 2012, Initially focused on an Income Share Agreement (ISA) product by contracting people to share a small amount to get their income. Upstart later shifted its focus to the personal loan in May 2014 offering 3-year and 5-year loan options. Upstart’s unique income and default prediction model assesses creditworthiness based on non-traditional factors like education and employment alongside traditional criteria such as FICO scores and income.

Also Read About: Revolut Company Case Study: A Fintech Success Story

Upstart Mission

Upstart’s Mission is to empower lenders to expand portfolios, enhance borrower approvals, and deliver a digital-first approach. Revolutionizing auto dealerships with seamless online-to-in-store car buying and financing. Join Upstart’s credit future!

Upstart Growth

Upstart’s CEO, Dave Girouard, formerly led Google Enterprise’s $1 billion cloud apps business worldwide, before that he worked as an Apple product manager.

Upstart Established in 2012, employs to enhance consumer loan approvals. It recently hired over 100 engineers and derives 98% of revenue from referrals to lending partners according to a report of Silicon Valley Business Journal and diversifying revenue sources becomes a priority,

Cross River Bank’s share decreased from 81% in 2022 to around 65% in 2023.

Between 2017 and 2019, Upstart’s revenue nearly tripled to $164 million. However, in Q2 of this year, the pandemic led to a 71% drop in loan transactions and a 47% overall reduction.

Despite this, Upstart loan company still achieved a 44% revenue growth compared to the same period, generating $146.7 million in 2020.

Notably, the growth rate is lower than the 72% and 65% rates in 2018 and 2019, respectively.

On November 5, Upstart filed with the SEC for an IPO, with details like share quantity and price range pending. So far, fintech has raised $165 million in funding and aims to raise $100 million under the ticker “UPST” on Nasdaq.

This follows Upstart’s shift to profitability in 2020, recording a $4.6 million profit in the first nine months, in contrast to a $10 million net loss in the same period last year.

Upstart Holdings priced its IPO at $20 per share on December 15, and the stock began trading the next day. Since then, shares have generally risen, recently extending beyond an IPO base.

On October 2, 2023, Upstart Holdings Inc.’s CTO, Paul Gu, sold 15,000 company shares, contributing to an ongoing trend of insider selling within the organization.

Upstart Funding

Upstart secured $144.1 million in funding across seven financing rounds. Key IPO stakeholders include Third Point Ventures (19.5%), Stone Ridge Trust (9.5%), Khosla Ventures (8.4%), Rakuten (5.3%), and First Round Capital (5.2%).

Upstart loan company has secured funding in seven rounds, with the earliest being on August 8, 2012, raising $1.8 million. In the following year, on August 27, 2012, they conducted a Venture Round, although the specific funding amount was not available.

Moving forward, Upstart conducted on April 22, 2013, and raised $5.9 million from First Round Capital. Continuing the growth trajectory, in October 2014, with Khosla Ventures contributing $18.9 million.

Then, in July 2015, Upstart secured $35 million from Third Point Ventures. In March 2017, Rakuten invested $32.5 million in the company during another funding round.

Finally, their most recent funding round was in April 2019, where they raised $50 million with The Progressive Corporation as the primary investor.

Upstart Products

Upstart loan products are beneficial for people who are looking for a better

future but don’t have that much money. In that case, an upstart company Offers some loan services for persons who’re looking for solutions related to money lending. Here are they-

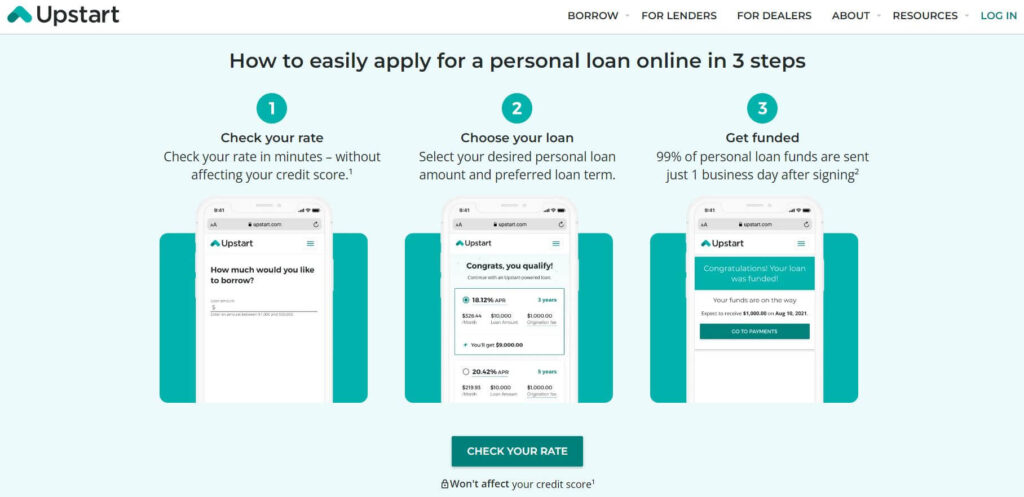

Personal Loans – Upstart allows you to obtain a personal loan with flexibility, up to $50,000⁵, offering fixed rates and terms of 3 or 5 years, featuring APR rates between 5.2% to 35.99%⁶. Enjoy the freedom to prepay your loan without incurring any fees or penalties.

Wedding Loans – Flexible wedding loans, quick rate check in 5 minutes, funding as fast as 1 business day, loan amounts from $1,000 to $50,000³, personalized rates based on education and employment.

Home Improvement Loans – Upstart a good loan company Select a home improvement loan amount from $1,000 to $50,000⁴. Tailor your loan to your needs with flexible 3 or 5-year term options. Benefit from an unsecured⁶ loan, eliminating the need for collateral.

Moving Loans – Secure your moving with ease – check your rate in 5 minutes, receive funds as fast as 1 business day, and apply for $1,000 to $50,000³. Our model considers more than credit score, assessing education and employment for a fair rate. Explore fixed-rate options of 5.2% – 35.99%, with no prepayment fees.

Medical Loans – Access a medical loan when needed – check your rate in 5 minutes, receive funds as fast as 1 business day, and apply for $1,000 to $50,000³. Our model assesses more than just your credit score, considering education and work experience for a fair rate. Explore fixed-rate options of 5.2% – 35.99%, with no prepayment fees.

Debt Consolidation – Streamline your finances with a debt consolidation loan – check your rate in 5 minutes, and receive funds as fast as 1 business day². Combine bills into one fixed monthly payment. Apply for $1,000 to $50,000⁴ with flexible terms of 3 or 5 years, offering fixed rates of 5.2% – 35.99%. No prepayment fees.

Credit Card Consolidation – check your rate in 5 minutes, and receive funds as fast as 1 business day. Merge bills into one fixed monthly payment, offering flexible loan amounts from $1,000 to $50,000. Select 3 or 5-year terms with fixed rates of 5.2% – 35.99%.

Car Refinance Loans – Save through auto refinancing: Get a personalized rate quickly, enjoy a seamless online process, and have no impact on your credit score. Upstart-powered car refinance loans start at $9,000² with terms from 24 to 84 months. Our model considers education and employment for custom rates, and there are no hidden fees like application or prepayment penalties.

AI In Remaking Upstart the Lending Procedure

Upstart AI lending by expanding credit decision data with over 1,500 variables.

Its advanced machine learning algorithms, trained on a massive 70 billion data cells, continually enhance their predictive capabilities.

Approx. 88,0004 daily repayments across partners, models adjust in real-time, offering precise default and prepayment predictions for each month of a loan term.

Automation is key, with AI handling identity verification, fraud detection, and income validation for a lending experience. Moreover, the Upstart Macro Index (UMI) aids lenders in understanding and adapting to economic fluctuations, addressing a crucial aspect of credit performance.

Summary

In Summary Upstart, is an AI lending company providing consumer loans. Initially focused on Income Share Agreements (ISAs), it shifted to personal loans in 2014, using a unique creditworthiness model that considers non-traditional factors like education. Despite a drop in loan transactions during the pandemic, Upstart filed for an IPO in 2023, aiming to raise $100 million. Its advanced AI algorithms analyze over 1,500 variables to enhance predictive capabilities, offering various loan products, including personal, wedding, home improvement loans etc. and this will benefit many more users in the future.

Reference Articles:

“Crunchbase – Upstart, Upstart (company)“

“CTO Paul Gu Sells 15,000 Shares of Upstart Holdings Inc“

“Upstart Holdings: Lending Platform Seeks AI Edge On Fintech Companies“